Procuring quality goods isn’t always just a case of heading down to the nearest shopping mall. Great denim (and the like) requires a healthy amount of research and often involves importing pieces by niche brands located in the farthest corners of the planet.But hey, we’re preaching to the choir here, right?

With worldwide shipping, though, comes the prospect of hefty (and often unexpected) import fees. Once every delivery service under the sun has tacked on their own charges, your shiny new jeans could end up costing far more than you ever imagined.

This presents a particular problem if you’re ordering high-priced items since charges are directly related to the value of what’s inside each and every exciting package. Given how much we champion all kinds of global makers in our editorials and online shop, we thought it high time to put together a guide on customs rules for some of the regions we serve the most.

To give you a good idea of how things compare, we’ve also calculated the average cost of extra fees on a pair of $350 denim jeans from Japan to each location. This is by no means definitive and can vary even due to the way customs declarations are filled out, but we hope it offers some food for thought.

Before we get started there are a couple of things you need to bear in mind. First, both postal companies and couriers often apply their own handling charges on top of the duties we’re outlining here, so you’ll want to be mindful of that when estimating the total of those new raw threads.

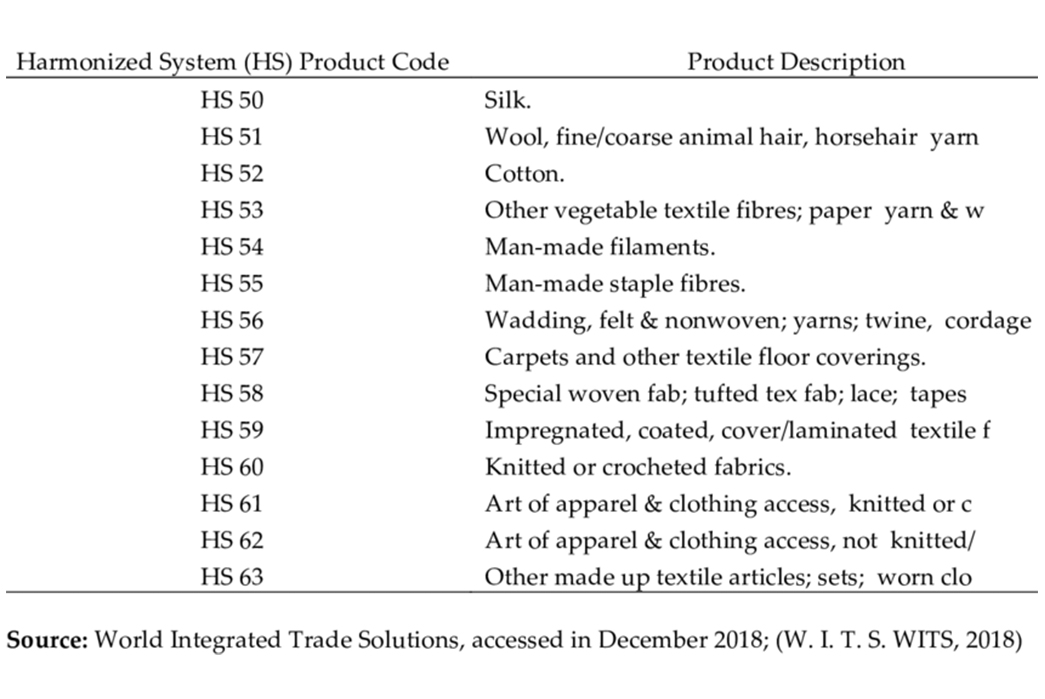

An example of part of the Harmonized Systems Code. Image via Research Gate

Second, every item imaginable is categorized under the Harmonized Systems Code, even down to, say, the percentage of cotton that’s in a garment you’ve ordered, and you’ll be charged customs duties according to a product’s classification.

That’s how every customs agency in the world deciphers your fees—so a linen shirt will still be classified under the same six-digit number no matter where it’s shipped to and from.

Importantly, not every country will charge the same for each category, and there is a huge range of possibilities for different items, so if you’re trying to understand where a new sweater will place in the index, then scrutinize the entire list of options very carefully.

Importing Items into the US

Image via CNN

Is there a duty-exemption threshold for items?

In short, it’s $800 on internet-purchases. The longer explanation is that, if your seller has marked the package as $800 or less, it should pass through the Customs and Border Protection mail branch without requiring them to assess it (unless it seems unusual or the paperwork is incorrect).

If your item is declared at a value higher value up to $2000 then the CBP will complete any extra paperwork and release it to you. This doesn’t mean it won’t be subject to import duty, though, and if items are priced above that number then they’ll be subject to even tougher checks. The CBP will also charge an additional processing fee for everything they have to assess.

Note that if you’re receiving a gift which is being sent directly to anyone other than the person who purchased it, the duty-exemption threshold drops to $100. In other words, if you’re ordering a nice new leather bag for a friend living in another city, then make sure it’s delivered to you first.

Do duties vary depending on what country the goods are imported from?

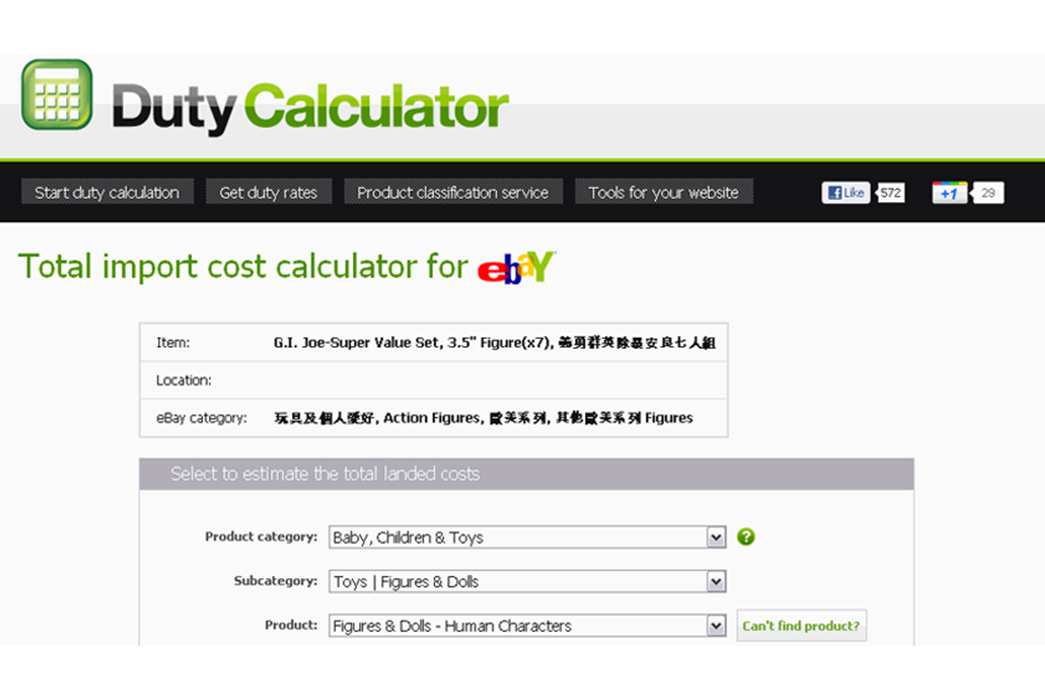

Yes—particularly if the U.S. has imposed restrictions on said country, or conversely if trade deals are in place (with Canada or Mexico, for example), then duties may be less or entirely exempt. To figure out exactly how much an import is going to cost you, give this duty calculator a go.

Where can you pay the fees and get the goods, pronto?

This depends on what method of shipping you’ve chosen to receive your item by, so it’s a really important thing to consider before you place an order. If your package comes through the postal service, it’ll be at your local post office, where you can pay any outstanding fees and have it released.

If you selected a courier, it’ll often take care of the duties and retrieve the package using an in-house customs broker, before passing the charges, and any handling fees onto you. They’ll also deliver it straight to your doorstep.

If freight was your choice, then make sure your package is shipped to a local entry port or that instructions are given on forwarding it to your address, lest you end up traveling halfway across the country to recover that new shirt. Unless there is a customs broker available to you, you’ll have to go and ‘enter’ the items yourself, so prepare for the paperwork.

How much will my jeans cost to import from Japan?

Based on a category of 620342 in the Harmonized Systems Code (yeah, we went there), a pair of cotton denim jeans valued at $350, including shipping, will most likely cost you a 10.3% duty, or an extra $36.05.

Importing Items into the UK

British Royal Mail’s Parcelforce depot. Image via Mezzanine

Is there a duty-exemption threshold for items?

If it’s declared as less than £135 then you won’t be charged anything, and gifts between that threshold and £630 will be subject to a flat-rate 2.5% duty. Keep in mind that this number is the total value of your package, including shipping, packaging and insurance costs, so the actual duty could end up being higher than you think.

Do duties vary depending on what country the goods are imported from?

Yes. Happily, if you’re ordering something from the EU then you won’t be charged value-added tax (VAT) since it’s already been added on, and there won’t be any customs duties to pay either. Costs will be applied if your item is coming from anywhere else.

The UK’s Revenue and Customs department advises you get in touch to check anything you’re unsure of, including what rates you might be subject to pay in accordance with the Harmonized Systems Code.

Where can you pay the fees and get the goods, pronto?

Again, this depends largely on your shipment method. If your package was sent with the good old postal service or Parcelforce courier service, then it’ll be waiting at your local Royal Mail post office for up to three weeks (at which point it will be returned to the sender).

Other courier companies and freight handlers will also keep hold of items for the same amount of time, and will take care of the customs fees before passing them onto you.

How much will my jeans cost to import from Japan?

That same pair of jeans (which equate to about £300 at the time of writing) we looked into earlier will attract 20% VAT and a 12% duty, which adds £103.72 onto your bill.

On a side note, there’s a relatively new trade deal in effect between the EU and Japan (which is great news for Europeans), but since the UK’s future is somewhat sketchy, we haven’t taken the agreement’s lower rates into consideration.

Importing Items into Canada

Duty calculators like this one can help you identify HSC categories and potential costs. Image via The Last Drop of Ink

Is there a duty-exemption threshold for items?

The lowest threshold we’ve seen so far—Canada deems everything over $20 liable for customs duties.

Do duties vary depending on what country the goods are imported from?

Somewhat, yes. While everything imported into Canada is subject to a 5% goods and services tax (GST), some items from the US might be exempt from customs duties under the North American Free Trade Agreement.

Be careful here though, because you may still be hit with other fees, and if the product wasn’t actually made in the States then it won’t qualify under the special rules.

Where can you pay the fees and get the goods, pronto?

Most of the time your chosen courier will take care of duties for your package on its arrival and will bill you for them, but be mindful of the potential for extra handling fees it’s likely to charge during this process.

You can also “self-account” for the duties on imports, which, unusually, means you’ll have to refuse delivery from the courier and go directly to a Canada Border Services Agency office to settle the fees. This is more hassle, but it avoids the aforementioned processing costs.

How much will my jeans cost to import from Japan?

Extra costs on our Japanese jeans (roughly $503 CAD) come in the form of taxes at 15.3% and a duty of 18%, totaling an extra $169.14 CAD.

Importing Items into Australia

Ah, the joy of unboxing new denim… once your duties are settled, of course. Image via Flickr

Is there a duty-exemption threshold for items?

You won’t be expected to pay duties, taxes or anything else on items that cost $1000 AUD or less, but the Australian Border Force does advise that you might be charged a goods and services tax by vendors in the country of origin.

For anything over that amount, you’ll pay an import processing charge in addition to duties and taxes.

Do duties vary depending on what country the goods are imported from?

The Australian Border Force doesn’t appear to have issued any advice on country-to-country restrictions or tariffs, however, there are several Free Trade Agreements in effect worldwide, so, for now, we’re going to advise that you check with the agency on a case-by-case basis.

Where can you pay the fees and get the goods, pronto?

There is a dedicated special online payment portal set up by the Australian Border Force, but the agency strongly advises that you consult with a customs broker if this is your first time and you’ve purchased expensive items.

How much will my jeans cost to import from Japan?

Our jeans, worth about $604 AUD, won’t incur additional duties thanks to the higher threshold on exemptions—happy days!

If you’re ever in doubt about extra fees then get in touch with your government’s customs department or check-in with a customs broker before buying—it’s better to be clued-up than to be stung by big expenses. And if you’re doing your own estimates then don’t forget that most customs duties should be worked out from the final cost of the package, including postage and insurance totals.